June 6, 2024

VIA EDGAR

United States Securities and Exchange Commission

Division of Corporate Finance

Office of Trade and Services

100 F Street, N.E.

Washington, D.C. 20549-7010

Attention: Abe Friedman

Theresa Brillant

RE: ARKO Corp.

Form 10-K for the Fiscal Year Ended December 31, 2023

Form 8-K furnished February 27, 2024

File No. 001-39828

Dear Mr. Friedman and Ms. Brillant,

On behalf of ARKO Corp., a Delaware corporation (the “Company”), the following response is to the comment letter, dated May 22, 2024 (the “Comment Letter”), received by the Company from the staff (the “Staff”) of the Securities and Exchange Commission (the “SEC”) concerning the Company’s Form 10-K for the fiscal year ended December 31, 2023 and Form 8-K furnished February 27, 2024.

For ease of reference, we have reproduced the text of the Staff’s comment in bold text followed by the Company’s response. In the response below, references to “we,” “our,” and “us” refer to the Company.

Form 10-K for Fiscal Year Ended December 31, 2023

Item 7. Management’s Discussion and Analysis

Segment Results, page 29

We respectfully advise the Staff that the amounts referenced above are accurate and present different information. The amounts in the tabular presentation represent the total contribution of each acquisition for the year ended December 31, 2023, whereas the amounts disclosed when discussing the reasons for our period over period change represent the aggregate incremental increase contributed by our acquisitions for the year ended December 31, 2023 as compared to the aggregate contribution for such acquisitions for the year ended December 31, 2022.

To further clarify, the amounts disclosed in our tabular presentation of results for our acquisitions for the year ended December 31, 2023 include the financial information and certain key metrics for each such acquisition for the period commencing on the later of January 1, 2023 and the date of such acquisition through December 31, 2023. For example, within the Retail Segment discussion in Management’s Discussion and Analysis, for the Pride acquisition, which closed on December 6, 2022, the financial information and certain key metrics in the table presented on page 29 represent the results of Pride for the full year period from January 1, 2023 through December 31, 2023. Similarly, within the Wholesale Segment and Fleet Fueling Segment discussion in Management’s Discussion and Analysis, for the Quarles acquisition, which closed on July 22, 2022, the financial information and certain key metrics in the tables presented on page 31 and page 32 represent the full year period from January 1, 2023 through December 31, 2023. For acquisitions that we closed during the year ended December 31, 2023, the information contained in the applicable table represents results from the date of acquisition through December 31, 2023. For example, the information presented for TEG in the table contained on page 29 includes TEG’s results for the period commencing on March 1, 2023 through December 31, 2023.

With respect to the discussion of the reasons for our period over period change within Management’s Discussion and Analysis, because the amounts disclosed and explained are the increased (incremental) amounts period over period, the amounts attributable to acquisitions include only the change (i.e. increase) in the contribution of the acquisitions between these periods. Therefore, when any such acquisition was partially included in 2022 results, the amounts attributed to 2022 for that acquisition were deducted from such acquisition’s 2023 results as presented in the table in order to disclose only the change year over year from such acquisition.

For example, in the acquisition table under the Retail Segment on page 29, the four presented acquisitions earned an aggregate of $213.5 million in merchandise revenue for the full year period from January 1, 2023 through December 31, 2023, whereas the discussion of the period over period changes within Management’s Discussion and Analysis, states that “the 2023 Acquisitions and the Pride Acquisition contributed approximately $209.5 million of incremental merchandise revenue.” (emphasis added) The $209.5 million discloses a change period over period and the difference between the $213.5 million figure presented in the table and the incremental change of $209.5 million disclosed in the discussion equals the merchandise revenue generated by the Pride retail stores for the period from December 6, 2022 through December 31, 2022. Similarly, the difference between the tables and the

discussion in the Wholesale Segment and Fleet Fueling Segments subtracts the results of the Quarles Acquisition for the period from July 22, 2022 through December 31, 2022, which were already reflected in the 2022 results.

In future filings, we will include a description of how we calculate incremental contribution within the Management’s Discussion and Analysis to more clearly explain our period over period changes.

Use of Non-GAAP Measures, page 34

Non-cash rent expense

We acknowledge the Staff’s comment regarding the exclusion of “non-cash rent expense,” and we have referred to Question 100.04 of the Staff’s Compliance and Disclosure Interpretation on non-GAAP financial measures. As disclosed in the footnote description of this adjustment, the adjustment eliminates the non-cash portion of rent, which reflects the extent to which our GAAP rent expense recognized exceeded (or was less than) our cash rent payments. The GAAP rent expense adjustment varies depending on the terms of our lease portfolio, which has been impacted by our recent acquisitions. We advise the Staff that we regularly assess how we approach the treatment of adjustments to arrive at Adjusted EBITDA, and we note that the Company’s management, when reviewing the Company’s financial performance, excludes non-cash rent expenses, as the Company believes these costs do not represent results of operation of the Company’s core business, and the chief operating decision maker (“CODM”) excludes such costs when allocating resources and otherwise making decisions with respect to the business. Furthermore, we understand that most of the research analysts that cover the Company adjust for non-cash rent expense in their financial models when determining Adjusted EBITDA, and we believe that the adjustment is helpful to an investor’s ability to analyze the Company’s core performance. However, in light of the Staff’s comment, we will modify our presentation of Adjusted EBITDA to discontinue the adjustment for non-cash rent expense.

Given our historical adjustment to Adjusted EBITDA, we plan to announce this modification as part of our earnings press release and earnings call for the quarter ending June 30, 2024. At that time, we also expect to address investor and analyst inquiries about this modification, including on a go-forward basis.

Specifically, our plan for the earnings press release and earnings call for the quarter ending June 30, 2024 is as follows:

We believe that the foregoing plan will provide for an orderly transition from the Historical Approach to the Revised Approach. The Company would commence presenting only the Revised Approach Adjusted EBITDA starting with the quarter ending September 30, 2024, and continuing through future disclosures, and the Company currently plans to include, as additional, stand-alone information, disclosure of non-cash rent amounts for all periods presented.

In the earnings press release and earnings call for the quarter ending June 30, 2024, we plan to disclose our guidance for fiscal 2024, which will include Adjusted EBITDA based only on the Revised Approach. We believe that updating our Adjusted EBITDA on this timeframe is in the best interests of our stockholders, as it will help mitigate confusion of investors and analysts in light of the fact that we have provided guidance for the year ended December 31, 2024 in our prior earnings releases using the Historical Approach.

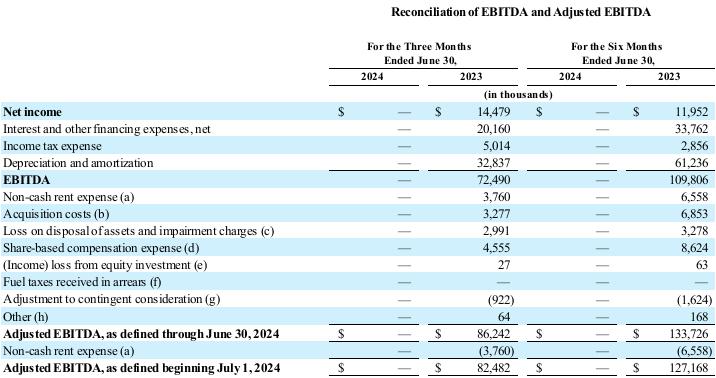

For the Staff’s reference, set forth below is an illustrative example of how we propose to present the planned changes in the definitions to Adjusted EBITDA and the impacted reconciliations in the Form 8-K, Exhibit 99.1 for the quarter ending June 30, 2024:

Changes in non-GAAP Definitions and Fiscal 2024 Guidance

Beginning in the third quarter of 2024, the Company has made certain changes to its definitions for Adjusted EBITDA that impact the comparability of the metric to prior periods. Specifically, the Company will no longer include non-cash rent expense adjustments in its calculation of Adjusted EBITDA. Accordingly, the Company’s 2024 Adjusted EBITDA guidance reflects the Company’s updated definition of Adjusted EBITDA. See

“Supplemental Disclosure of Non-GAAP Financial Information” below for a reconciliation of the definitions prior to the third quarter of 2024 to allow for like-for-like comparisons to the new definitions for all periods presented.

Supplemental Disclosure of Non-GAAP Financial Information

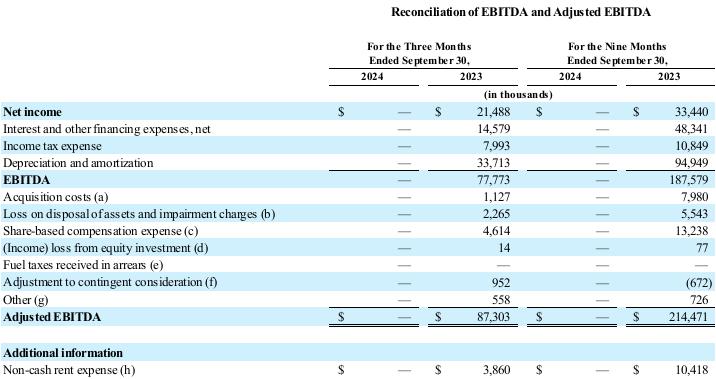

For the Staff’s reference, set forth below is an illustrative example of how we propose to present the planned changes in the definitions to Adjusted EBITDA and the impacted reconciliations in the Form 8-K, Exhibit 99.1 for the quarter ending September 30, 2024:

Supplemental Disclosure of Non-GAAP Financial Information

Acquisition costs adjustment

The Company acknowledges the Staff’s comment relative to its acquisition costs adjustment and respectfully advises the Staff that the Company has completed numerous acquisitions that resulted in incremental acquisition-related costs, including payroll-related costs, which would not otherwise have been incurred absent these acquisitions. The Company has four employees who are primarily responsible for executing its acquisition strategy and facilitating integration of acquired operations. The Company can reasonably estimate the amount of time and related salary cost attributable to each employee’s contribution to researching, negotiating, executing and integrating acquisitions.

Additionally, as part of integrating stores after acquisition, when current store managers train store managers at the newly acquired locations, their salaries during this period are viewed as acquisition costs because this supplemental training activity is not viewed as part of such persons’ core job responsibilities. Other team members are paid to cover for the store managers at their home store, which is a measurable, additional payroll cost that is incremental to acquisitions and not part of our core segment operations.

The total of these amounts is removed in the Company’s calculation of Adjusted EBITDA in the line item of acquisition costs and were $1.7 million, $1.3 million and $1.3 million for the years ended December 31, 2023, 2022 and 2021, respectively.

The Company regularly manages the economic balance of maintaining employees for acquisition-related activity versus the cost of outsourcing these services to third-parties. The Company believes it is more economical to utilize employees for certain of these activities rather than incurring third-party acquisition costs.

The Company acknowledges that these costs are not non-recurring, and does not present them as non-recurring, because they relate to past distinctive projects occurring over a defined timeline, or relate to unique circumstances, and the Company generally will incur such costs in connection with any future acquisitions; however, the Company believes that the exclusion of such costs in the calculation of Adjusted EBITDA provides investors with more accurate comparisons of the Company’s financial results to historical operations and the financial results of less acquisitive peer companies. Furthermore, the Company believes these costs do not represent results of operation of the Company’s core business, and the CODM excludes such costs when allocating resources and otherwise making decisions with respect to the core business.

Also, the Company does not consider these payroll-related adjustments to be related to the organic continuing operations of the Company, inclusive of the applicable acquired businesses, and these costs are generally not relevant to assessing or estimating the long-term performance of the Company’s business. In addition, the size, complexity and volume of past acquisitions, which often drives the magnitude of such costs, may not be indicative of the size, complexity and volume of the Company’s future acquisitions. The Company believes that its Adjusted EBITDA measure, which excludes such payroll-related acquisition costs,

allows the Company’s management and investors to better evaluate the Company’s core business operations both with, and without, such costs. As such, management believes these adjustments are in compliance with Question 100.01 of the staff’s Compliance and Disclosure Interpretations “Non-GAAP Financial Measures.”

Item 8. Financial Statements

Consolidated Statements of Operations, page F-4

In response to the Staff’s comment, and after consideration of Rule 5-03(1)(a) of Regulation S-X, the Company will revise its disclosure in future filings to present fuel excise taxes on the face of its consolidated statements of operations.

23. Segment Reporting, page F-51

In response to the Staff’s comment and after consideration of ASC 280-10-50-22, the Company will revise its segment disclosures in future filings to remove the line item of total revenues from segments for each segment presented and for each period presented.

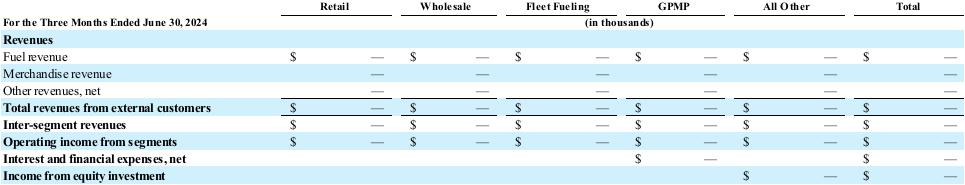

For the Staff’s reference, set forth below is an illustrative example of how we propose to present the revised segment disclosure for the quarter ending June 30, 2024:

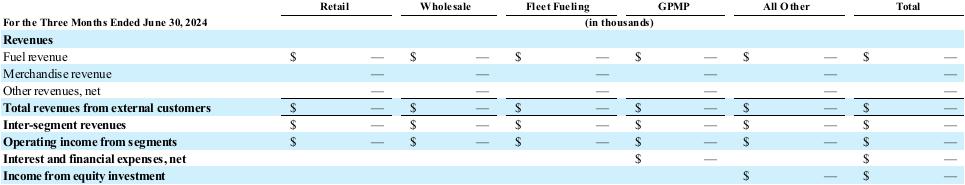

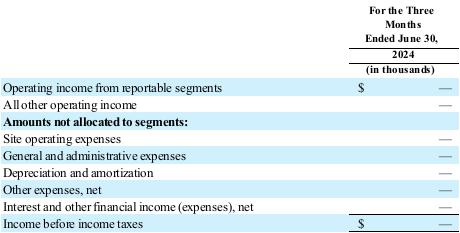

In response to the Staff’s comment and after consideration of Item 10(e)(1)(ii)(C) of Regulation S-K, the Company will revise its segment disclosures in future filings to remove the line item of net income from segments for each period presented. The Company advises the Staff that the CODM uses operating income from each segment to assess its operating performance and to make decisions about allocating resources to such segment. As such, the Company will revise its segment disclosures in future filings to include a reconciliation from operating income from reportable segments to consolidated income before income taxes.

For the Staff’s reference, set forth below is an illustrative example of how we propose to present the revised segment disclosures for the quarter ending June 30, 2024:

Form 8-K furnished February 27, 2024

Exhibit 99.1, page 1

In response to the Staff’s comment, in future presentations and discussions of non-GAAP measures, the Company will ensure that comparable GAAP measures are presented and discussed with equal or greater prominence.

Sincerely,

ARKO Corp.

By: /s/ Robert Giammatteo

Robert Giammatteo

Executive Vice President and Chief Financial Officer

cc: Drew M. Altman, Esq., Greenberg Traurig, P.A.